Do you want to know the best WooCommerce payment gateways for your online store? If yes, then you’re in the right place for that.

WooCommerce payment gateways are crucial parts of every WooCommerce store. They define which payment methods your customers have access to. Moreover, it determines how you receive payments from your customers.

Hence, choosing the right WooCommerce payment gateway is a vital decision. But it may be hard to find the most suitable one for your store.

Thus, in this article, we’re going to cover the best WooCommerce payment gateways. With that, you can choose the right option for your WooCommerce store. Now, let’s begin!

What is a WooCommerce Payment Gateway?

Before going right into the list, let’s learn more about WooCommerce payment gateways.

A payment gateway is a platform that offers services to accept payment for the products you sell online. This means you don’t have to deal with the legal and financial hassles of processing money yourself. The third-party payment gateway will do that for you.

Moreover, an online payment gateway links customers and retailers. Hence, it can take care of your customers’ details to perform transactions.

Basically, there are 2 kinds of payment gateways to use in your store. They are:

- Redirect: This type of payment gateway redirects customers to a payment processor to complete the transaction. For example, PayPal is such a payment processor.

- Direct: Direct gateways happen right in your store. So, customers don’t have to leave your site for transactions. For instance, Amazon and Shopify use this method.

As a WooCommerce store owner, you should use a payment gateway that supports your WooCommerce store. In conclusion, a WooCommerce payment gateway is a third-party service that accepts online payments on your WooCommerce store.

With that being said, let’s see how you should choose a WooCommerce payment gateway.

How to Choose the Best WooCommerce Payment Gateway?

If you have a new WooCommerce store, then you must carefully select the correct payment gateway. As all payment gateways don’t have the same policies and features.

Hence, these are the different criteria you must consider while choosing a WooCommerce payment gateway. After going through them, select the one that matches your needs.

- Transaction Fees: Most payment gateways charge a fee after every transaction in your store. So, you can compare the prices and find a gateway with the right amount of transaction fee concerning its features.

- Other Charges: Apart from transaction fees, some services charge you additional fees like set-up fees, maintenance fees, etc. Hence, be aware of unnecessary charges.

- Recurring Payments: Many payment gateways let you receive recurring payments. If your business requires automatic renewals, then check if they have this feature.

- Compatibility: WooCommerce accepts major payment gateways with the help of extensions or payment plugins. So, make sure they are compatible with your store.

- Availability: Importantly, look if your payment gateway supports your and your users’ area. Payment gateways aren’t available everywhere due to legal restrictions.

- Currencies: The WooCommerce payment gateway you choose must support various currencies. At least make sure it supports the currencies of your consumers.

These are the top ways to choose from the best WooCommerce payment gateways for your store. It also includes factors like ease of use, security, customer service, online reputation, etc.

Keeping that in mind, let’s move into the list of the best WooCommerce payment gateways. First, start with a quick summary of it!

Summary of the Best WooCommerce Payment Gateways 2023

| Payment Gateway | Built-in WooCommerce Integration | Pricing | Standard Transaction Fee | Trustpilot TrustScore |

| Stripe | Yes | Free | 2.9% + 30 cents per transaction | 3.3/5 |

| PayPal | Yes | Free ($30/mo for PayPal Pro) | 2.9% + 30 cents per transaction | 1.3/5 |

| Authorize.Net | Yes | $25/mo | 2.9% + 30 cents per transaction | 1.9/5 |

| FastSpring | No | Depends | Depends | 2.6/5 |

| WooCommerce Payments | Yes | Free | 2.9% + 30 cents per transaction | 2.7/5 |

14 Best WooCommerce Payment Gateways for Your Store

Here are the best WooCommerce payment gateways for your online store. It also includes their features, availability, payment methods, fees, and cons.

So, go through them, and you can finally select the one that fulfills your store’s needs. Now, here we go!

1. Stripe

Stripe is one of the most popular payment gateways to accept payments on your WooCommerce store. It’s easy to set up and use. So, millions of businesses, like Shopify, Amazon, and Squarespace are using Stripe.

Moreover, WooCommerce has built-in support to choose Stripe as your payment gateway. Also, you can find various WordPress payment plugins that give more functionality when integrating the Stripe payment gateway.

Further, it lets you create customizable forms with Stripe Elements for your store. Plus, using Stripe Elements makes your forms PCI-compliant (Payment Card Industry). Ultimately, your customer’s payments will always be secure.

Key Features:

- It works as a white label. This means customers can pay without going to an external payment page, making them feel safe.

- Includes extensive reporting features. Like monthly transaction history, monitoring integrations, managing refunds, etc.

- Contains built-in fraud detection and prevention with Stripe Radar and 3D Secure.

- Gives easy-to-use APIs (Application Programming Interface) for developers.

- Supports Strong Customer Authentication (SCA). And you can capture authorizations and process refunds from the WooCommerce dashboard.

- Supports recurring payments, so you can use a membership or subscription plugin.

Cons:

- It’s not available in all countries.

Availability:

Stripe is available in 40+ countries. Most of them are from Europe and North America. While other countries are Australia, India, Malaysia, etc. Also, it supports 135+ currencies.

Payment Methods:

Stripe supports around 12 payment methods based on your account type and location. Some of them are:

- Credit and debit card payments.

- Payment wallets like Google Pay, Apple Pay, etc.

- Local payment methods such as Alipay or iDeal in about 25 countries.

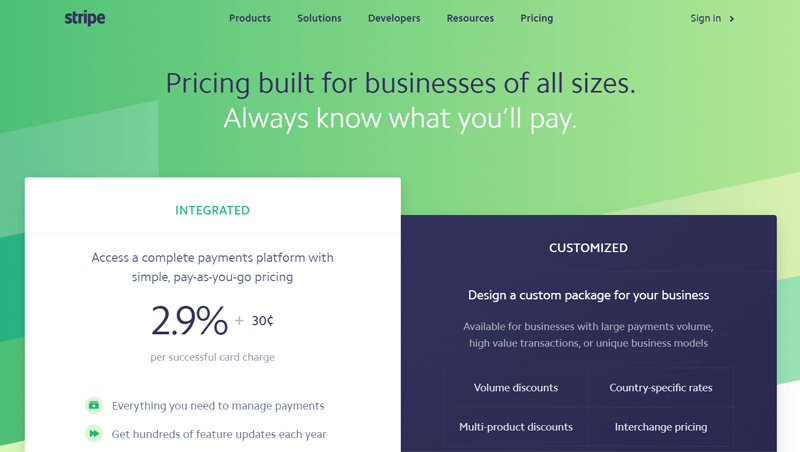

Fees:

This payment platform has a simple, pay-as-you-go pricing service. It charges 2.9% plus 30 cents per successful transaction for online payments. Here, you’ll get everything to manage payments and hundreds of future feature updates.

However, this is the standard fee for cards issued in the US. If not, then you’ll have to pay an extra cost based on the exchange rate.

Best of all, there are no setup, monthly, or hidden fees in Stripe. And the integration is free!

2. PayPal

PayPal is one of the most trusted pioneers in the payment industry. It’s an API-based solution for personal, business, or eCommerce sites. Similarly, WooCommerce gives built-in support for using PayPal on your online store.

However, the free PayPal service doesn’t offer an on-site checkout experience. So, your customers redirect to the PayPal site to complete the purchase.

But purchasing PayPal Pro gives more customization features. Now, the entire checkout process can happen right in your store.

Key Features:

- You and your customers can get professional invoices on store activities via mail.

- Provides customer financing options. For example, customers can buy now and pay later with special financing.

- It can accept payments in person from any computer with PayPal Terminal.

- Choose if your funds get transferred to your PayPal account or bank account.

- You can find everything on your PayPal dashboard. There, you can export any data and run a few reports.

- Includes fraud and chargeback capabilities with Seller Protection policy. Hence, it can monitor all your transactions for security.

Cons:

- Comparatively, the fees are higher than other payment solutions.

- There can be improvements in its customer service.

Availability:

PayPal is available in over 200 countries across the globe. That includes African, Asia Pacific, American, and European countries. Also, it supports over 25 currencies.

Payment Methods:

Now, let’s look at the payment methods offered by PayPal. Some of them are:

- Accept payments directly through PayPal.

- Also, it supports all credit and debit cards. That includes MasterCard, Visa, American Express card, etc.

- It even accepts bank transfers, phone payments, and in-person payments.

Fees:

PayPal charges you based on your account type, location, and the number of sales. To be exact, it has a standard fee of 2.9% plus 30 cents per transaction.

In addition, it can charge 1.5% extra for international transactions and a 1% fee for the instant transfer service. Similarly, there can be other restrictions, excluding setup fees.

As said before, PayPal is a free WooCommerce payment gateway. While PayPal Pro offers more features. Thus, getting a PayPal Pro program will cost you $30/mo.

3. Authorize.Net

Do you want a payment gateway for your large business? Then, one of the best payment gateways owned and operated by Visa is Authorize.Net. Since many users with large monthly sales are using it for their business.

Further, this payment doesn’t have a built-in integration with WooCommerce. However, it can integrate with WooCommerce by using an available free or paid WooCommerce plugin.

Similar to Stripe, Authorize.Net keeps your customers in your store while processing the payment. For that, it contains various customization options for your payment pages.

Key Features:

- Includes an intuitive dashboard that shows your payments in a grid. Also, you can capture payments and process refunds with a few clicks.

- Automatically captures transactions when the order status changes to a paid status.

- Accept.js and PCI compliance standards give improved security.

- Customers can save their payment method to their account for easy checkout.

- Ability to create eye-catching payment forms at checkout with Retina icons.

- Gives mobile-friendly checkout with numerical inputs for card type/security code.

- Support add-ons like WooCommerce Subscriptions and WooCommerce Pre-Orders.

Cons:

- Works in just a few countries relative to other payment gateways.

- Focuses on large businesses. So, it may not be preferable for smaller businesses.

Availability:

Authorize.Net is available in countries like the US, Canada, Europe, Australia, and the UK. This is comparatively less than other payment gateways you can find.

Payment Methods:

In terms of Authorize.Net, these are the payment methods it supports:

- Accepts major credit and debit cards. Some of them are Visa, MasterCard, American Express, Discover, etc.

- Payment wallets like Apple Pay, Chase Pay, etc.

- Further, it supports eCheck payments. Plus, Authorize.Net can display authorization confirmation messages for eCheck transactions.

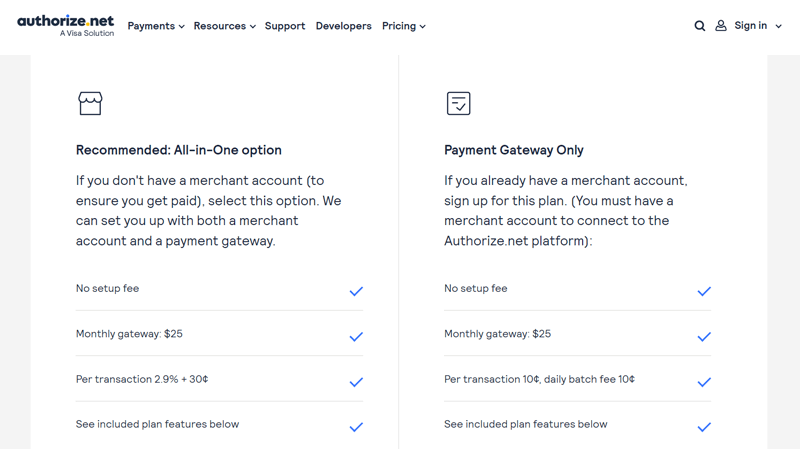

Fees:

Similarly, the standard fee of this payment gateway is 2.9% plus 30 cents per transaction. And it doesn’t ask for setup fees, but others may apply.

Moreover, it’s a paid payment solution. So, the monthly price of using this payment gateway is $25/mo.

4. FastSpring

A global payment gateway best for SaaS (Software as a Service) and software companies to sell online is FastSpring. It’s an all-in-one solution that can handle any payment. So, it supports one-time purchases, recurring payments, subscriptions, and more.

Additionally, WooCommerce offers its WordPress plugin for the integration of FastSpring. Using this plugin, you’ll get full-service eCommerce service for your WooCommerce store.

Further, it has an intelligent payment routing function. This can route payments to payment gateways in the same region as the customer making a purchase on your store automatically. If a payment fails, then the system tries for an alternative gateway.

Key Features:

- Able to automatically calculate, collect, and remit sales tax, VAT, and GST taxes in the checkout process.

- Lets you set up free trials on your store without collecting payment information.

- Ability to set up ready-to-handle billing subscriptions with a few clicks.

- Gives an intuitive checkout experience. You can embed it anywhere in your store or show it through a popup display.

- It can proactively stop payment fraud, spam content, and irregular chargebacks.

- Provides business insights and helps you understand the impact from one place.

Cons:

- Requires technical experience to set up and use.

- There can be improvements in its user interface.

Availability:

This payment gateway is present in 200+ regions of the world. Moreover, it supports 23+ currencies and 21+ languages. Overall, the availability of this payment service is great!

Payment Methods:

The list below shows some payment methods available in FastSpring:

- Local payment methods like Alipay, Apple Pay, etc.

- All major credit and debit cards.

- Manual check in USD for the US.

- Other gateways like PayPal.

Fees:

FastSpring doesn’t add extra fees for every feature. It has flat-rate pricing depending on the features you use. So, you can use its features, including payment processing, subscriptions, global tax collection, local payment methods, etc. And based on them, you need to pay.

Because of that, it doesn’t specify the charges it takes. Since it all depends on various needs. So, you must talk with the sales team. For that, you’ve to send them all your necessary requirements.

5. WooCommerce Payments

If you want a trustable payment gateway, then you can use WooCommerce Payments by the WooCommerce team. It deeply integrates into your store to give various payment solutions.

Moreover, this service accepts both in-person and online payments. Best of all, you can connect the WooCommerce mobile app and a card reader (US and Canada). As a result, you can track the store’s revenue from both methods in one place.

Key Features:

- Provides a secure and easy checkout experience for customers.

- Users can save their credit cards from which you can reward those repeat customers. Ultimately, it improves conversions and reduces cart abandonment.

- Supports recurring payments. Hence, you can add subscriptions, memberships, etc.

- View the store details, like payments, refunds, orders, etc., from the dashboard. So that you don’t have to use a separate payment processor.

- Ability to set a custom deposit schedule to get your funds into your bank account. It can be daily, weekly, monthly, or on-demand.

Cons:

- Doesn’t allow you to import historical data.

Availability:

WooCommerce Payments is available in 18 countries globally. Some of them are Australia, Canada, Germany, Italy, Singapore, Spain, etc. While it can support 135+ currencies.

Payment Methods:

The following list shows some payment methods present in WooCommerce Payments:

- Accepts major credit and debit cards.

- Local payment methods like iDeal, EPS, P24, and more.

- Other payment gateways like PayPal.

- Digital wallets such as Amazon Pay, Google Pay, etc.

Fees:

This payment service is free to install without setup fees or monthly charges. However, as a pay-as-you-go service, the standard price starts at 2.9% plus 30 cents per transaction for US-issued cards. The cost differs for other cases.

6. Square Payments

Square provides multiple solutions for eCommerce businesses of all sizes, one of which is Square Payments. It’s a payment gateway specialized for in-person stores. However, it can also accept online, remote, and manually-entered payments. This means it can process any of the latest payment services.

On top of that, you can easily use a Square extension for WooCommerce. With Square and WooCommerce, it can synchronize sales, inventory, and customer data from all channels. Then, you can manage them from one central place.

Key Features:

- Performs end-to-end encryption and is PCI compliant without any security fees.

- Recurring customers can save their favorite payment methods by adding labels for easy identification.

- Lets you authorize transactions when your customers finish an order. Then, capture the payment after product shipment.

- Ability to view transaction details of items for improved reporting.

- It has a dedicated payment dispute team. Also, you can send documents for dispute management from the dashboard.

- Offers SEO (Search Engine Optimization) tools for store optimization.

Cons:

- Focused on in-person sales rather than online eCommerce.

- It’s available in a few countries only.

Availability:

Square Payments is available in some countries like the US, the UK, Australia, Japan, etc. Similarly, it supports a few popular currencies for payments.

Payment Methods:

In the case of payment methods, Square Payments has the following options:

- Accepts debit and credit cards.

- Also, it offers Square gift cards to use.

- Other payment methods include Apple Pay, Google Pay, etc.

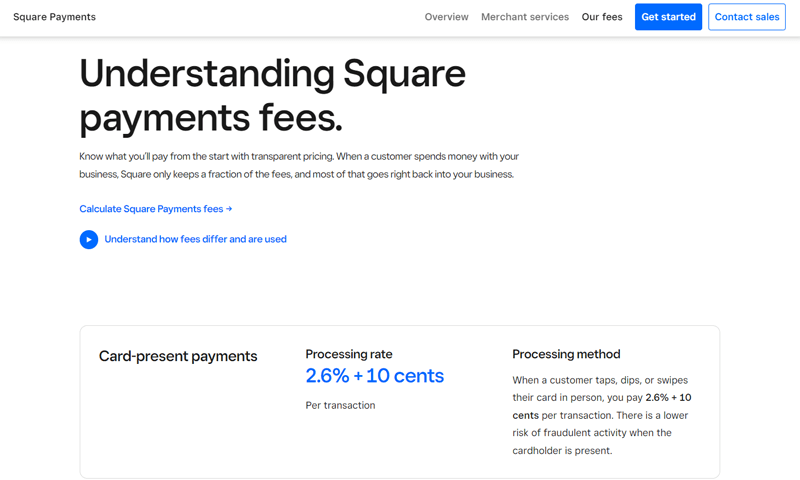

Fees:

Square Payments is a free WooCommerce payment gateway. Further, the fees in this payment gateway are present in the following price options:

- Card-present payments: 2.6% plus 10 cents per transaction (when a user tap, swipe or dip a card)

- Card-not-present-payments: This option has 2 other categories:

- 3.5% plus 15 cents per transaction (when you manually key in your customer’s card details or use a card on file).

- 2.9% plus 30 cents per transaction standard fee from other online means.

7. Alipay

One of the most popular WooCommerce payment gateways is Alipay by the eCommerce giant Alibaba. There are millions of users in China using Alipay. So, if your target country is China, then choose Alipay straight.

Nevertheless, it also works as a cross-border payment gateway for global business. Hence, this payment gateway is also available in other parts of the world.

Further, it’s a fully integrated payment gateway for WooCommerce. So, it’s easy to set up. You need to open the standard WooCommerce payment gateway settings. And on the screen, enter the partner ID and security code.

Key Features:

- Comes with a free Alipay test account. Here, you can test transactions, plugins, etc.

- Supports about 64 different languages due to the support of Google Translate.

- Customers can purchase products from their Alipay account with their info saved.

- Gives world-class security from privacy protection and real-time monitoring features.

- Works for both in-person and online payments of your store items.

Cons:

- The main focus of this payment gateway is the Chinese market.

Availability:

Alipay is used across many countries worldwide. For example, India, Thailand, Korea, etc. But it’s ideal for China-related businesses and customers. Plus, it supports currencies like Renminbi, Euro, Australian Dollar, US Dollar, etc.

Payment Methods:

This payment gateway mostly supports the payment methods that Chinese customers use. For example, it offers direct payments in the Alipay system. Other than that, it supports credit and debit cards.

Fees:

Alipay charges you 0.55% per transaction (that’s for up to RMBY 20,000).

You can find free and paid WordPress payment plugins/add-ons for integrating Alipay into WooCommerce. For example, the Alipay Cross Border Payment Gateway costs $79/year.

8. Amazon Pay

Amazon Pay is a popular payment processing solution by Amazon. It’s a unique service for those who sell their products on Amazon. And when they wish to connect their stores with WooCommerce. And the integration between them is free of cost.

Best of all, your customers don’t need to enter their payment info on a third-party site. It lets them pay for their orders using payment methods saved in their Amazon accounts. So, they don’t have to create a new account. But having an active Amazon account is a must.

Key Features:

- Provides advanced fraud protection. Ultimately, it reduces chargebacks and fraud.

- Amazon offers the latest technology, like shopping with the customer’s voice.

- Supports recurring payments letting you add subscriptions and memberships.

- The automatic decline handling function can reduce lost sales from customers.

- Sends alerts to customers on the arrival of physical goods orders.

- Built-in support to SCA and PSD2 (Second Payment Services Directive) compliance.

Cons:

- Usually, it takes longer for payouts.

Availability:

Amazon Pay is available in around 170 countries. Such as Japan, the US, the UK, Spain, Australia, and others. Similarly, it supports multiple currencies like AUD, NZD, DKK, etc.

Payment Methods:

Moving forward, this payment gateway supports the following payment options:

- It accepts credit and debit cards like MasterCard, Visa, Diners Club, etc.

- Amazon’s store cards are usable for selected merchants.

Fees:

As a free payment gateway, it only charges some extra fees. The standard fee is 2.9% + 30 cents per transaction.

9. Verifone

Verifone (previously 2Checkout) is a global payment solution that accepts payments from worldwide. Further, it contains a powerful API to integrate with other carts like Wix, Shopify, Ecwid, WooCommerce, etc. This makes it ideal for your WooCommerce store.

Moreover, it offers flexible purchase options and configurable shopping carts. It means you can select the right checkout experience for your consumers. That can be hosted carts with responsive design and optimized purchase flows. Or an inline cart that’s mobile-friendly.

Key Features:

- Accepts both online payments and mobile payments from your buyers.

- Able to experiment with the cart layouts and purchase flows with built-in A/B testing.

- With intelligent payment routing, your transactions will receive the highest payment authorization rates.

- Takes care of sales tax management, invoicing, compliance, and more.

- Offers a subscription management function to accept payments in subscriptions.

- Customers can shop in their own language and see their local currencies.

Cons:

- There can be improvements in its security options.

- The charges are a little higher than other payment gateways.

Availability:

Verifone is available in over 200 countries across different regions of the world. That includes Europe, Africa, Asia Pacific, and America.

Best of all, it supports 30+ languages. Plus, you can see the billing in 100 currencies.

Payment Methods:

Verifone provides around 45 different payment methods. These are some of the popular methods:

- Accepts credit and debit cards like Visa, MasterCard, American Express, and others.

- Supports bank transfers.

- Other options include Apple Pay, Skrill, PayPal, and more.

Fees:

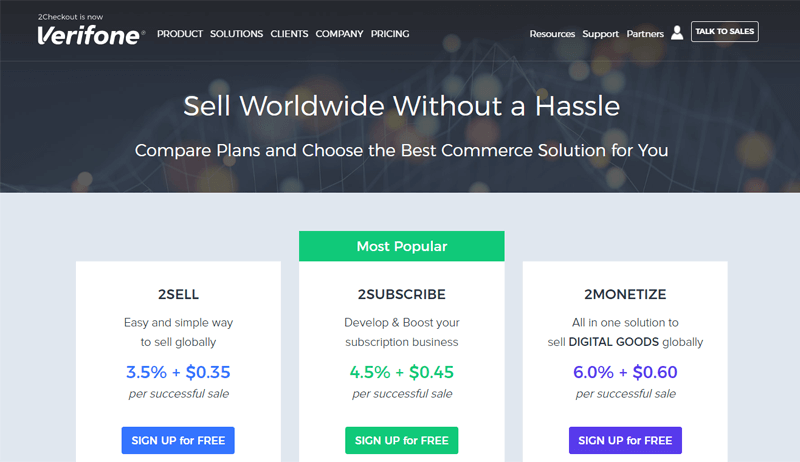

There’s no built-in integration of Verifone and WooCommerce. However, you may find free or premium plugins to get this function.

The pricing of Verifone is divided into 3 options. They are:

- 2Sell: 3.5% + 35 cents per transaction, 200 countries, 120+ carts, and more.

- 2Subscribe: 4.5% + 45 cents per transaction, smart subscription management tools, all 2Sell features, etc.

- 2Monetize: 6.0% + 60 cents per transaction, 45+ payment methods, every 2Subscribe feature, and others.

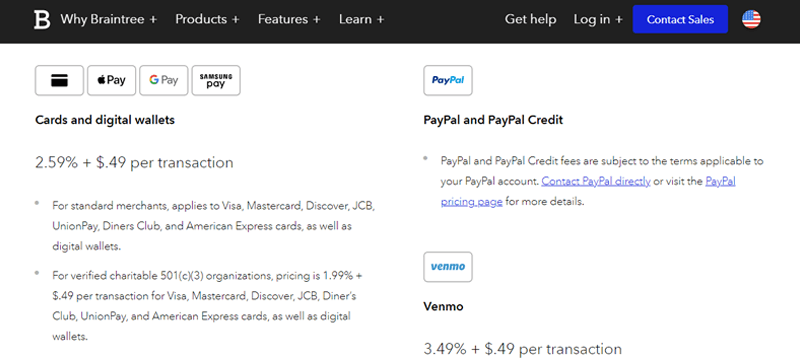

10. Braintree

If you want to use PayPal with some advanced features for free, then choosing Braintree is ideal. This service lets customers pay from their PayPal account and complete the checkout process on your WooCommerce store. Plus, it’s trustable because it’s from PayPal.

Apart from PayPal, Braintree can also accept credit cards. Moreover, customers can also save their PayPal or credit card payment details, making an easier shopping experience.

On top of that, you can choose a ready-made payment interface for checkout. Also, it has express checkout options. For example, you can add Buy Now buttons on product pages and PayPal Connect buttons in the cart.

Key Features:

- Ability to detect and prevent fraud using its extensive suite of fraud tools.

- Able to process refunds, void transactions, and capture charges from WooCommerce.

- Routes payments in different currencies to various accounts with a currency switcher.

- Supports SCA and PCI compliance standards for outstanding security.

- Gives Hosted Fields to add the checkout form elements on your store for secure transactions.

- Provides key insights on transactions in the control panel.

Cons:

- It should provide better customer service to its users.

Availability:

In terms of availability, Braintree is present in 45+ countries globally. Some countries include Australia, Belgium, Canada, Italy, the US, and more.

Payment Methods:

As said before, Braintree specializes in PayPal payments. Other than that, the following are the payment methods it provides:

- Major credit and debit cards. That contains Visa, MasterCard, Discover, etc.

- Also, it supports digital wallets like Apple Pay, Google Pay, Samsung Play, etc.

Fees:

WooCommerce has a built-in integration to Braintree for free. Hence, it doesn’t ask for payment to get this payment gateway.

But Braintree charges a standard fee of 2.9% + 30 cents per every successful transaction. While other charges may also apply.

11. Apple Pay

Another WooCommerce payment gateway on our list is Apple Pay by Apple. It’s designed specifically for Apple products like iPhones, Apple Watches, and other iOS devices.

Additionally, you can also use it in online stores and physical shops. There may not be a direct integration of WooCommerce and Apple Pay. But with payment solutions like Stripe, you can accept Apple Pay directly in your WooCommerce store on mobile or desktop.

Key Features:

- Customers must confirm their password and FaceID/TouchID while making a payment.

- It’s well-designed and simple. Hence, you can give an attractive visual experience to customers in their checkout process.

- You can use Apple Cash. It’s a digital card that stores the cash you receive or want to send.

- Your customers can use device-specific numbers and unique transaction codes. So that their card number is never stored on devices/servers.

- The purchase information is private in Apple Pay. It’s only used for fraud prevention and troubleshooting.

Cons:

- Best for Apple device users specifically.

- Apple Cash is available in the US only.

Availability:

You can use Apple Pay in 40+ countries in Europe, North America, Asia, and the Middle East. Some countries are Argentina, Brazil, Hong Kong, Singapore, etc.

Payment Methods:

Apple Pay accepts most credit and debit cards. Further, it also accepts in-person cash with Apple Cash.

Fees:

This payment gateway charges 0.15% per transaction on US purchases. Further, there’s no additional cost other than what the credit card companies charge. So, it’s a free integration.

12. Skrill

Skrill is a popular payment gateway used by millions of users worldwide for online purchases and transactions. It’s also an ideal payment solution for an eCommerce business like your WooCommerce store.

Moreover, you can easily capture the payments from a quick checkout process. For that, you can add cards, wallets, bank transfers, and several cash payment methods. This means you can receive payments from abroad on your bank account, mobile wallet, or Skrill wallet.

Key Features:

- The digital wallet lets customers quickly pay with an email address and password.

- With the instant bank transfer solution, it supports 3000+ banks globally.

- Supports integration to all the major shopping carts. With that, you’ll get access to many credit card and local payment options.

- Includes enhanced fraud and risk management standards for optimum security.

- Contains chargeback protection for smooth transactions without any loss.

- The frictionless payment function can add a 1-tap for repeat payments with a single touch.

Cons:

- Its customer support service can have improvements.

- The verification service can take some time.

Availability:

Skrill can offer its services in over 200 countries. That includes America, Europe, and Asia Pacific regions. Moreover, it can access and manage 40+ currencies on an account.

Payment Methods:

As mentioned before, the payment methods Skrill supports are:

- Credit and debit cards.

- Skrill wallet and other digital wallets.

- Instant bank transfers.

Fees:

Skrill is free for the first 6 months in case of personal use. If not, then it charges around Euro 5.

Similarly, there are various other charges it takes. For example, receiving money doesn’t take a charge.

But for transfer, it varies based on the payment method used. The standard fee for accepting payments from credit cards is up to 2.99% of a transaction.

13. Adyen

Adyen is yet another one of the top payment gateways for WooCommerce stores. You can find an Adyen WooCommerce plugin that integrates into the WooCommerce checkout process seamlessly.

Furthermore, it accepts payment both online and in person. This means you can receive payment from the web and app with recurring payments or pay by link. Plus, it lets you connect and manage in-person payments.

Key Features:

- It’s a unified commerce solution that connects both in-person and online payments.

- Protects your business from fraud, improving conversion and authorization rates.

- Gives cross-channel insights for understanding your customers and their journey.

- Easily lets you add several payment methods plus integrate local payment options.

- You can generate your own physical or virtual payment cards. Ultimately, it lets users send funds.

Cons:

- A slight learning curve for beginners.

Availability:

All the payment methods Adyen supports are available in different countries. For example, local payment methods are present in 40+ countries. Great!

Payment Methods:

Adyen has over 90 different payment methods available in total. You can use the preferable ones according to the availability in your country.

Some of the payment methods are:

- Online: Alipay, Amazon Pay, Apple Pay, JCB, Discover, and more.

- In-person: Apple Pay, Alipay, Bancontact, PayPal, Visa, and others.

Fees:

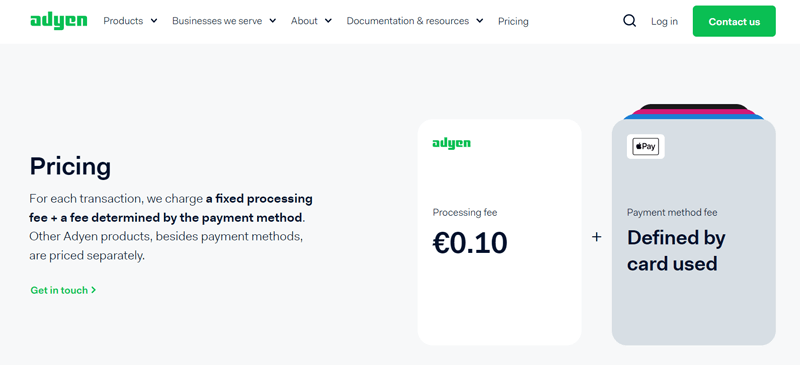

For integrating Adyen into your WooCommerce store, you can find free plugins to do so.

In Adyen, the charge amount for every transaction is a fixed processing fee + a fee determined by the payment method.

Hence, the fixed processing fee it charges is €0.10. For example, the payment method fee for Alipay is 3% per transaction.

14. Mollie

Mollie is one of the fastest-growing payment gateways in Europe. Because it offers several local payment methods for Europe. However, you can also use it to accept payments from your WooCommerce store from online or app transactions globally.

On top of that, it comes with a customizable checkout process. It means you can edit the order, title, and description of payment methods. And setting up Mollie will take about 15 minutes in any of your preferred languages.

Key Features:

- Integration with WooCommerce Subscriptions lets you manage your subscriptions for debit and credit cards.

- With transparent pricing, you can pay the fees only for successful transactions.

- It supports full and partial payment refunds.

- You can configure the payout times. It can be daily, weekly, monthly, or others.

- Accepts live payments in your WooCommerce store within 1 minute.

- Gives a personalized Mollie dashboard from where you can access real-time data and insights.

Cons:

- Focuses more on offering payment services in Europe.

- Available in a few countries only.

Availability:

In total, Mollie is available in 11 countries, including Belgium, Spain, the UK, and others. Also, it supports a variety of languages like English, German, French, etc.

Payment Methods:

Mollie supports both online and local payment methods. Moreover, it’s a payment gateway that offers more local payment methods overall. Some of them are:

- Online: Visa, PayPal, MasterCard, and more.

- Local: iDeal, Klarna, Belfius, and many others.

Fees:

Mollie has built-in integration with WooCommerce. So, it’s totally free to use.

While the standard transaction fee is €0.25. Plus, a certain percentage of your every transaction adds up based on the payment method. For example, using MasterCard takes up 1.8% of transactions.

Conclusion

And it’s a wrap! This ends our article on the best WooCommerce payment gateways.

Here, we gave you the top 14 payment gateways for your WooCommerce store. Among these, we recommend using Stripe.

Because it’s one of the most popular solutions with ideal availability, payment methods, fees, and features. Also, it has built-in integration with WooCommerce for free.

However, you can go ahead with any other payment service as well. The choice is all yours! For more questions, you can comment below. We’ll be glad to give you answers.

Further, you can read some of our similar blogs. They are how to integrate Payoneer in WordPress WooCommerce and the best Payoneer alternatives for small businesses.

Lastly, share this article with your friends, family, and colleagues. And if you liked such articles, then follow us on Facebook and Twitter to find similar content.