Are you looking for the best Payoneer alternatives for online payment? If that’s the case, then you’ve landed in the right place.

If you want to target clients worldwide, then you need to expand your eCommerce or freelancing business. To do so, you’ll need to integrate a solution that enables you to receive and send payments across the globe.

Similarly, Payoneer is one of such payment solutions that allow your business to reach the new global economy. Payoneer helps you make international payments, receive funds, manage online business, etc.

However, before deciding on a particular online payment gateway, it’s always good to check out several other alternatives to Payoneer. So, in this article, we’ve hand-picked some of the most popular Payoneer alternatives.

What is Payoneer?

Payoneer is one of the popular payment gateways that provides tons of possibilities founded in 2005 in New York City. With over 5 million Payoneer users and 24 worldwide offices serving more than 200 countries, it’s powering the growth of customers for entrepreneurs.

It’s designed for the needs of today’s cross-border sellers. As a result, it lets you make transactions in multiple countries and currencies. You can get paid by any world’s leading marketplaces, pay your suppliers and VAT for free, and manage multiple stores in one place.

Similarly, it’s an end-to-end solution for freelancers and businesses providing services to clients worldwide. Whether you work with clients directly or via freelance marketplaces, Payoneer offers multiple ways for you to get paid and pay your subcontractors.

In case you want to integrate Payoneer into your WordPress site for your WooCommerce store, then we have a tutorial blog for you. So, make sure to check it out!

Features of Payoneer:

- This platform lets you create your local currency account in another country and get paid like a local bank account.

- You can also request payments from your clients worldwide, and clients can make payments easily with just a few steps.

- It also lets you combine all your eCommerce business and view payment activity in one place.

- Also, easily make payments to your suppliers and contractors from your Payoneer balance.

- It’s integrated with popular marketplaces like Fiverr, Upwork, Airbnb, 99Designs, iStock, etc.

- You can also withdraw your Payoneer balance at ATMs or request a prepaid card online and in-store.

- Plus, you can send payments to another Payoneer account for free.

Payoneer Pricing:

You can receive payments from another Payoneer account for free regarding pricing. However, receiving payments via credit and debit card, it’ll charge a 3% transaction cost for credit card and a 1% service charge for ACH bank debit.

Similarly, if you withdraw local currency from a Payoneer balance of a different currency, then it’ll cost 2% of the transaction amount. At the same time, bank processing fees, landing fees, or other intermediary fees may be deducted from the withdrawn amount by your bank.

However, payment methods may vary by country. And, the fees shown are maximums and may be lower depending on the recipient.

Payoneer appears to be the ideal online payment gateway, doesn’t it? This, however, may not be the same for everyone! Let’s have a look at why this is the case.

Why Do You Need a Payoneer Alternative?

Payoneer is undoubtedly one of the most popular online payment platforms on the market, talking about which users of Trustpilot rate 4.4 stars out of 5 by 39,617 real users. Similarly, Payoneer scores 3.6 stars out of 5 stars ratings by 219 real users in G2.

Therefore, Payoneer is a reliable online payment gateway as per the ratings on a different platform. Also, it provides one of the best features for online businesses and freelancers.

However, there are plenty of excellent online payment service providers to pick from. Furthermore, some online payment gateway may be better than others in terms of meeting your demands.

So, take a look at some of the reasons that you might want to switch to one of the alternatives of Payoneer.

- It can take 2-3 business days to complete a transaction.

- There’s a minimum withdrawal limit of $100.

- Also, the platform has very slow customer service.

- There is an annual flat fee of $29.95 even if you’ve not made any transaction in the last 12 months.

- There are high card transaction fees and high exchange fees compared to other online payment platforms.

However, don’t be concerned!

Several alternative online payment service providers are equally outstanding that can fit your needs. So we’ll explore all of the Payoneer alternatives and see how they stack up against the Payoneer.

Summary of Best Payoneer Alternatives for Small Business & Freelancers

| Payoneer Alternatives | Account Opening | Receiving Money | Sending Money Fees | Currency Transfer |

| PayPal | Free | 2.89% + fixed fee | 2.89% + fixed fee | 2.89% + fixed fee |

| Wise | Free | Free ($4.14 charge for USD wire payments) | 0.35% (varies according to currency) | 0.35% (varies according to currency) |

| Zen | Free | Starting at $1.07 | Starting at $1.07 | No fee till $5400 |

| Skrill | Free | Free | Free for local banks, 1.25% fees for global payments | 3.99% on wholesale rates |

7 Best Payoneer Alternatives for Small Business & Freelancers in 2022

We’ve come up with a list of the best Payoneer alternatives and their crucial features. So, go through each alternative to determine which is suitable for you other than Payoneer.

1. PayPal

PayPal is one of the best online payment services. It’s easy to use and reliable. Almost every freelancer has a PayPal account. Also, you can use this platform for small to medium businesses.

In addition, you can quickly receive money from PayPal by entering your email address or by using the merchant payment solution. Also, it accepts up to 25 currencies and provides customers with invoice options.

PayPal Key Features & Advantages over Payoneer:

- Send money globally by depositing into bank accounts, and sending for pickup or delivery in 130+ countries with Xoom service.

- Recipients don’t need to have a PayPal or Xoom account to receive the money.

- It also provides QR codes to send and receive money.

- You can also sign up for a merchant account and let your customers pay by credit and debit cards.

- Also, it integrates well with WooCommerce, Shopify, Swappa, etc.

PayPal Cons

- It does not come with a free trial.

Pricing

You can sign up for PayPal for free. There are various commercial transaction rates like invoicing, PayPal checkout, and PayPal guest checkout costs 3.49% + fixed fee. Whereas a fixed fee for commercial transactions is based on currency received. For example, for US dollars, it’ll add up an extra $0.49.

Also, QR code transaction costs 2.40% + fixed fee for $10 and below. Send or receive money for goods and services cost 2.89% + fixed fee, and standard credit, and debit card payments cost 2.99% + fixed fee. And all other commercial transactions cost 3.49% + fixed fee.

PayPal Support and Customer Reviews

When it comes to customer support, PayPal provides a decent level of service to its customers. It makes sure that customers can easily reach out to them. So, they’ve got a simple approach to answering the queries.

They offer community forums, resolution centers, and live chat. Moreover, they also have a FAQ section, where you can find answers to basic questions.

Trustpilot

As per the TrustPilot, 1.2 stars out of 5 stars, which 21,424 real users evaluate. You can find the recent review here.

G2 Reviews

Likewise, G2 reviews have 4.2 stars out of 5 evaluated by 1,831 real users. Also, you can find the recent study here.

Final Verdict

Undoubtedly, PayPal is the most comprehensive online payment service provider in the market. One of its key features is that PayPal supports more currencies to transfer.

With PayPal, you can open an account in almost any country, whereas Payoneer allows 200+ countries. While talking about the currency exchange fee, Payoneer charges up to 3.5%, and PayPal charges 2.5% on top of the bank’s rate.

Even though PayPal has fewer ratings than Payoneer, it’s worthy of trying as one of the best Payoneer alternatives.

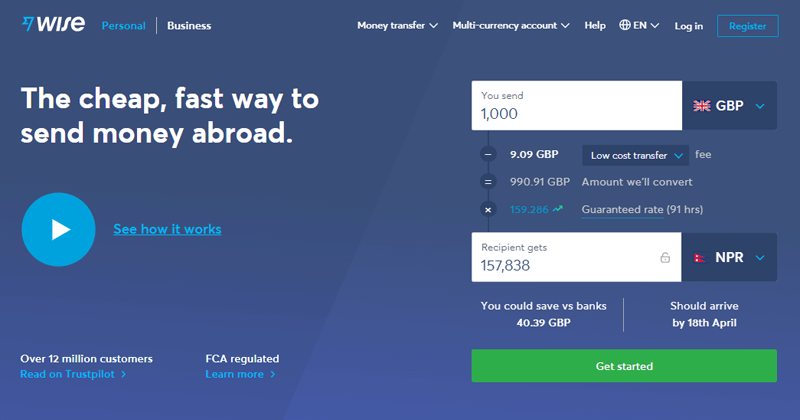

2. Wise

Wise is a cheap and fast way to send money abroad. This money transfer service is best for freelancers and businesses who want to receive from foreign clients without the hassle of cards or any type of form. Also, you’ll receive the payment in your local bank account in local currency.

You can send money to any of the 80 countries that the platform supports right now. In addition, you can hold and convert your money into 53 currencies. Some of the currencies are Dirham, Peso, Niara, and more.

Wise Key Features and Advantages over Payoneer:

- Wise has the lowest transfer fees in comparison to any of the platforms.

- Also, the platform is transparent throughout the remittance process, while many platforms fail to do so.

- In addition, the platform does not charge mark-up for exchanges but matches the mid-market rate as closely as possible.

- Wise safeguards your money with established financial institutions like leading banks in a country.

- In addition, the platform uses 2-factor authentication to protect accounts and your transactions.

Wise Cons

- The delivery time is slower during the transfers.

Pricing

You can register for the platform for free. The lowest charge is 0.35% while sending money. However, this rate varies according to currency. Also, while receiving USD wire payments, there is a fixed charge of $4.14 in the payments.

While sending money abroad, the charges vary according to the amount, currency, and payment method. You can check the transfer charges here.

Wise Support and Customer Reviews

Wise offers a blog and FAQ section providing all the relevant information about the payment platform. Also, the topics are categorized as sending money, managing accounts, holding money, and more. In addition, the fees calculator and pricing section gives you a clear overview of the charges and delivery time.

Trustpilot

Wise has an Excellent rating of 4.6 stars out of 5 stars from 151,952 registered users. You can check the latest reviews here.

G2 Reviews

Also, the platform has 4.4 stars out of 5 stars in G2 reviews. You can check the most recent reviews here.

Final Verdict

To conclude, Wise is a decent platform that offers you everything you need to transfer funds. When it comes to transaction speed, Wise usually takes 24-48 hours, whereas Payoneer takes up to 72 hours.

Also, Wise is suitable for both private clients and individuals. Payoneer is for small businesses and individuals who receive payments from businesses abroad. Similarly, Wise is an easy solution that allows you to send money abroad for any purpose.

With the best review by its users, Wise is also one of the best Payoneer alternatives.

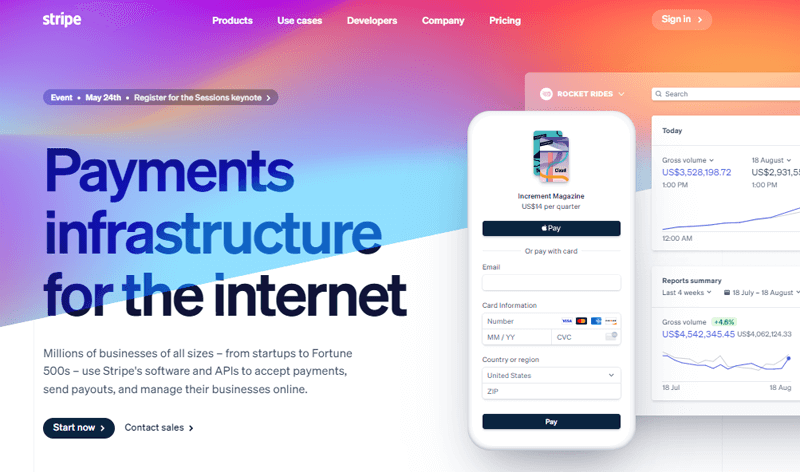

3. Stripe

Stripe is another popular payment gateway and an excellent alternative to Payoneer. Also, this platform serves millions of businesses of all sizes. Also, with the help of this platform, you can accept, send, and manage payments.

In addition, Stripe provides a full suite of payment options. Also, the platform focuses on payment methods of apps and websites. Some payment features include subscription services, online and in-person retailers, and more.

Stripe Key Features and Advantages over Payoneer:

- The machine learning model of Stripe is trained from billions of data points to help increase revenue, revenue recovery, and more.

- You can make payouts via stripe, which can be in multiple currencies and cross-border for international and multi-currency transactions.

- Also, there are security features like Dynamic 3D Secure to avoid fraud.

- In addition, the platform is accessible via smartphones, web, and custom interfaces.

- Furthermore, there are multiple payment options like cards, digital wallets, cash vouchers, etc.

Stripe Cons

- The platform is supported only in a limited number of countries.

Pricing

For online purchases via card or services like Apple Pay, or Google Pay, you have to pay 2.9% plus 30 cents per transaction. However, in the case of wire transfers, you’ll have to pay $8 per transfer.

Stripe Support and Customer Reviews

You can get support 24/7 from their support staff, 7 days a week. You can contact the support team via email, chat, and phone call.

Also, there is a dedicated technical team where you can have live conversations with the developers. In addition, the help section provides related articles on keywords you search.

Trustpilot

Stripe has 3 stars out of 5 stars reviews in Trustpilot from 7,246 users. Also, you can check out the latest reviews from here.

G2 Reviews

In addition, Stripe has a 4.4 stars score out of 5 stars in G2 reviews. You can check out the latest reviews here.

Final Verdict

To sum up, Stripe is relatively a newcomer compared to Payoneer for online payment gateway. Yet, it has convinced many users by providing a wide range of features. Generally, it’s for business owners who accept many payment methods from cards to buy now, pay later, etc.

Also, Stripe is more developer-friendly in comparison to Payoneer. In addition, the APIs and SDK are easy to automate and integrate. Therefore, resulting in the extensive use of the platform in online shops and apps.

Moreover, this user-friendly online payment platform helps you to transfer funds quickly. Thus it comes with all the features you’ll need for online payment.

Therefore, Stripe, no doubt, is one of the best Payoneer alternatives.

4. Zen

Zen is a payment platform that suits both individuals and businesses and can be an excellent alternative to Payoneer. Also, this platform has more than 20 payment methods to choose from, including Mastercard, VISA, and more.

Another great advantage of using the platform is exchange rates. This platform provides exchange rates that are lower than that of banks. Also, the rates update constantly, and the platform guides on every step.

Zen Key Features and Advantages over Payoneer:

- Zen has instant cashback up to 15%, which can be ideal if you make frequent online purchases.

- Also, while using this platform, you’ll get a one-year extended warranty on electronics items bought with Zen Mastercard.

- In addition, the digital financial suite, in cooperation with Mastercard, encourages consumers, entrepreneurs, and freelancers to manage their finances.

- Also, you can pay in 30 international currencies without any commission fees.

- Furthermore, you can get 20+ payment methods at the best rates on the market.

Zen Cons

- The customer service is not flexible as on other platforms.

Pricing

Zen comes in two pricing plans with a 30-days of trial in both premium plans.

- Gold Plan: With a monthly payment of $1.07, you can exchange currency up to $5400 without any fees and a 1-year extended warranty on products up to $1621.

- Platinum Plan: With a monthly payment of $5.39, you can exchange unlimited amounts of currency without any fees and a 1-year extended warranty on products up to $5403.

Zen Support and Customer Reviews

You can search the help center for your queries or get help from the FAQ section. Also, you can contact the Zen sales team for any kind of inquiry. In addition, the website is available in 8 different languages to help international clients.

Trustpilot

This platform has 3.6 stars out of 5 stars in Trustpilot reviews from 303 users. You can read the recent reviews about the platform here.

G2 Reviews

Zen has a 4 stars score out of 5 stars in G2 reviews. In addition, you can read the latest reviews here.

Final Verdict

Overall, Zen is a wonderful online payment solution for businesses and freelancers. It’s simple to use and includes various features such as 1 year of extended warranty on selected electronics products.

Also, the cashback feature of up to 15% encourages online shopping. In addition, the Gold plan is way cheaper than the flat fee of $29.95 on Payoneer.

As a result, it’s one of the most effective Payoneer alternatives.

5. Skrill

Skrill is an online payment and money transfer service provider. You can deposit funds into your Skrill wallet using a variety of methods. Such as credit cards, bank transfers, and more. Furthermore, you can use the money to pay other Skrill users, merchants, etc.

Additionally, on many popular routes, Wise can send money within one day, as the same-day transfer or even an instant money transfer. However, different payment methods or routine checks may affect the transfer delivery. Also, you can keep track of each step of your transfer in your account.

Skrill Key Features and Advantages over Payoneer:

- Skrill practices the highest security standards that comply with the Payment Card Industry (PCI) security standard.

- You can instantly buy and sell cryptocurrencies with the help of these platforms.

- Also, the Skrill 1-tap feature offers frictionless checkout that improves customer experiences.

- Knect is the Skrill loyalty program via which you can exchange points with cash rewards.

- Furthermore, the VIP program offers awesome features like lower fees, higher limits, and invite-only events.

Skrill Cons

- Skrill has a limited customer support option lacking features like live chats.

Pricing

You can make local bank transfers with no fees. Also, you can make global payments like Visa and Mastercard with 1.25% fees. In addition, you can withdraw funds with 2% on Crypto Wallet and 3.99% Visa and Mastercard.

Skrill Support and Customer Reviews

Skrill provides details where you can browse and read about your topics of interest. In addition, there is a FAQ section for customer convenience.

Trustpilot

Skrill has an Excellent score of 4.7 stars out of 5 stars from 10,210 registered users. You can check out the latest reviews here.

G2 Reviews

Also, Skrill has a 3.4 stars score out of 5 stars in G2 reviews by 54 verified users. Furthermore, you can check out the latest reviews here.

Final Verdict

Altogether, Skrill has been around the longest in the market than Payoneer and has many advanced online payment service features. One of the best features of Skrill is the digital wallet to hold funds and transact in 40+ countries.

In addition, the payment system of Skrill is secured with the highest security standards that comply with the Payment Card Industry (PCI) security standard. Furthermore, this platform has an advantage over Payoneer in individual fund transfers.

Therefore, Skrill is another better alternative to Payoneer.

6. SquareUP

SquareUP is a payment platform that provides flexible business solutions that perfectly work for you. Also, this platform offers built-in payments and customer-driven checkout and POS services.

In addition, you can set up a free online store and integrate your existing online payments. Furthermore, you can create and send digital invoices or sell by text at any time.

SquareUP Key Features and Advantages over Payoneer:

- This platform provides automatic fillings of federal, state, and local payroll taxes so that you can focus on your business.

- You can turn your computer into a virtual credit card terminal for remote billing and cards over the phone.

- Also, the platform provides hardware like iPad to POS, phone terminals, contactless chip readers, and more.

- In addition, you can integrate platforms like WooCommerce, Wix, and more.

- Furthermore, you can put payments and banking together with easy-to-use tools to manage cash flows.

SquareUP Cons

- Lacks cross-border payments for transferring revenue to owners.

Pricing

The software is free to use without any setup and monthly fees. You only have to pay while taking payments. The processing rate is 2.6% plus 10 cents. In addition, you can create custom pricing for more than $250K in card sales.

SquareUP Support and Customer Reviews

The support section offers articles on different topics. Also, you can get live help from the support team via phone, email, live chat, and social media. In addition, the platform has a community to help customers.

Trustpilot

This payment platform has an excellent review of 4.5 stars out of 5 stars from 3449 registered users. You can check the latest reviews here.

G2 Reviews

Also, the platform has 4.4 stars resting in G2 reviews based on 29 users. You can read the latest reviews here.

Final Verdict

In summary, SquareUP is one of the best solutions for online payment services. When it comes to transferring speed, SquareUP takes 36 hours or 1-2 business days based on business closing time. In contrast, Payoneer takes 2-3 business days within the US or 2-5 days globally.

The best part is that SquareUP comes with Square Point of Sale and third-party POS integration, whereas Payoneer lacks these features.

SquareUP offers credit card processing or business transactions by retail and online business costumes. But, Payoneer does not.

Thus, looking at all these features, SquareUP is unquestionably worthy of being one of the top alternatives to Payoneer. And you must give it a try.

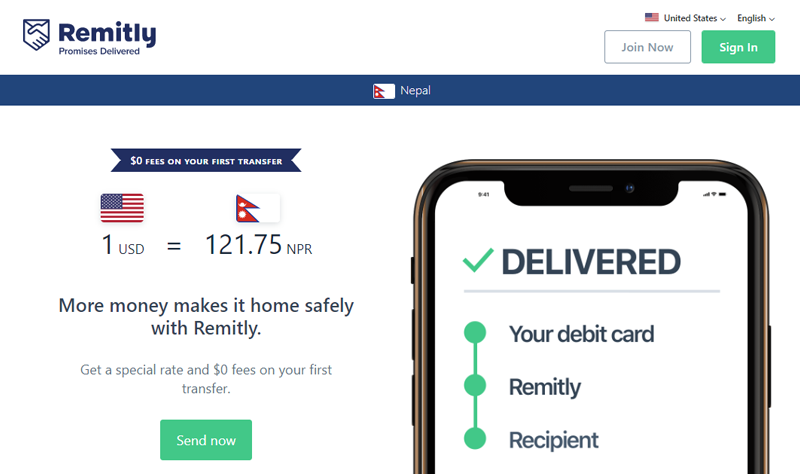

7. Remitly

Remitly is another best Payoneer alternative that is a combination of great rates and low fees. It’s a global payment company that uses mobile technologies to send money worldwide.

Moreover, you can easily send minimal amounts and relatively large amounts. With Remitly, you can receive money quickly, like in hours instead of days. Also, it provides options like paying quickly and cash pickup.

Remitly Key Features and Advantages over Payoneer:

- Send funds within minutes from your phones and get status updates for you and your recipient.

- You can transfer money from the UK, US, Australia, Canada, Ireland, Germany, France, and many more to over 50 countries worldwide.

- Also, you can make person-to-person money transfers in over 135 countries.

- In addition, you make the transactions within minutes from your phone.

- Remitly has a fantastic mobile app that is easy to use and reliable.

Remitly Cons

- There is a low limit on how much money you can send at once.

Pricing

It offers a $0 fee on your first transfer when it comes to pricing.

You’ll have 2 ways of transferring Express and Economy. If you choose the Express plan, it charges a high transfer fee but has a fast delivery time. Whereas, in the Economy plan, the delivery charge is a minimum to none depending on the country you choose. But takes a longer delivery time, from 3-5 business days.

Remitly Support and Customer Reviews

Remitly has a dedicated help section where you can learn about its services via articles and FAQs. Also, the help center is available in 14 languages, and also you can get 24/7 chat services in English, French, and Spanish. In addition, the 24/7 phone support is available in English and Spanish.

Trustpilot

Remitly has 4.1 stars out of 5 stars in Trustpilot. This is based on 34,594 registered users. Also, you can read the latest reviews of the platform here.

G2 Reviews

Also, Remitly has 4.2 stars out of 5 stars in G2 reviews from 10 verified users. You can check out the latest reviews here.

Final Verdict

Remitly has one of the best customer care in the industry. For sure, the 24/7 chat and phone in multiple languages beats the customer support of Payoneer with ease. In addition, the mobile app that Remitly provides is responsive and well optimized.

Also, you can find one of the cheapest rates in money exchanges compared to Payoneer. Furthermore, you can transfer the money with minimum to no fees for the slow delivery time.

Therefore, Remitly is another excellent alternative to Payoneer.

Conclusion

That’s all, folks! We’ve arrived at the end of this article.

We’ve discussed the 7 best Payoneer alternatives for small businesses and freelancers. We hope you’ll agree with our list of alternatives to Payoneer.

Although the decision is yours, we recommend you to go with Wise as it’s one of the best Payoneer alternatives. In addition, it comes with handy features like receiving a transferred amount in a local bank and very low transfer fees.

Also, we’re hoping that this article helped you find the best alternatives to Payoneer for 2022. If you’re using any of these platforms, then please share your experience below in the comment section.

In case you’ve any more queries, then feel free to ask us. We’ll get back to you as soon as possible. Also, share this article with your friends and colleagues.

You can also check our article on the best WordPress price comparison plugins and the best WordPress payment plugins.

Also, follow us on Twitter and Facebook for more useful articles.